Question # 1

There are 10 parts to Question 1.

For each of the parts (a) to (j) below there are four possible answers A, B, C and D.

Choose the one you consider correct and place a tick (Ö ) at the

correct answer.

(a) Why does the owner of a business calculate profit?

| A | to find out how much debtors owe him |

| B | to find out how much he owes to creditors |

| C | to know how much money may be taken as drawings without reducing capital |

| D | to reconcile the cash book balance with the balance on the bank statement |

(b) What is another name for a copy of a customer’s account in the sales ledger when it is

sent to the customer?

| A | credit note |

| B | debit note |

| C | invoice |

| D | statement |

(c) It is important to match a business’s expenses to the appropriate accounting period.

Why is this?

| A | the business needs to pay the correct amount of expenses |

| B | to calculate the correct profit or loss for the period |

| C | to calculate unpaid expenses for the period |

| D | unpaid expenses cannot be carried forward to the next year |

(d) Paul returns goods previously purchased on credit from Peter.

Where will this transaction be recorded in Peter’s accounting records?

| book of prime (original) entry | nominal (general) ledger |

| A | purchases returns journal | credit purchases returns account |

| B | purchases returns journal | debit purchases returns account |

| C | sales returns journal | credit sales returns account |

| D | sales returns journal | debit sales returns account |

(e) A business made a loss for the year.

What effect would this have on the balance sheet?

| A | decrease current liabilities |

| B | decrease net assets |

| C | increase capital employed |

| D | increase capital owned |

(f) Which item would appear in a partnership income statement?

| A | interest on loans from partners |

| B | interest on partners' capital |

| C | interest on partners' drawings |

| D | partners' salaries |

(g) A limited company has issued debentures.

Which statement is correct?

| A | Debentures are part of the share capital |

| B | Debentures earn a fixed rate of interest |

| C | The holders of debentures can vote at shareholders' meetings |

| D | The rate of dividend on debentures varies according to profits |

(h) Which is not used to calculate cost of production?

| A | inventory of finished goods |

| B | inventory of raw materials |

| C | purchase of raw materials |

| D | work in progress |

(i) Which is the best indicator of the liquidity of a business?

| A | current ratio |

| B | quick ratio |

| C | return on capital employed |

| D | working capital |

(j) Suzanne’s financial year ends on 31 December.

She carried forward the closing inventory on 31 December 2010 so it became the

opening inventory at the start of the following financial year.

Which accounting principle is Suzanne applying?

| A | business entity |

| B | consistency |

| C | going concern |

| D | money measurement |

Question # 2

(a) Give two examples of a current asset.

(b) State the accounting equation.

(c) Mikhail rents a workshop for his car repair business. In the table below, place a tick (Ö �)

under the correct heading to show whether his expenditure is capital or revenue.

| Capital expenditure | Revenue expenditure |

| Repairs to workshop windows | | |

| Installation of alarm system | | |

| Storage shelves for tools | | |

(d) Name the section of the ledger in which you would find the following accounts:

(i) a customer's account;

(ii) the provision for bad debt account.

(e) (i) Susie’s trial balance does not balance. Give one example of an error which may have been made.

(ii) Japo has bought inventory for $1000 but this has been entered in his books as

$1100. Name the error which has been made.

(f) For the year ended 30 September 2011 Ahern’s business had sales of $125000, cost

of sales of $85000 and expenses of $15000.

Calculate Ahern's percentage of net profit to sales. Show your workings.

(g) Arthur’s cash book showed a debit balance of $2400 on 30 September 2011. He

received a bank statement dated 30 September 2011 showing that cheques issued to

the amount of $860 had not been presented for payment.

Calculate the balance shown on the bank statement at 30 September 2011.

(h) Farling Limited has issued share capital of 120000 ordinary shares of $0.25 each and

10000 preference shares of $1.00 each.

State the amount of share capital shown in the company balance sheet.

Question # 3

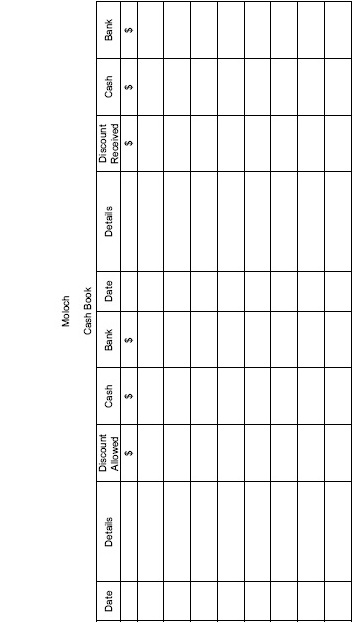

Moloch has a furniture store and sells goods for cash and on credit. He puts the cash

receipts in his cash box and enters them into his three-column cash book each week. He

offers a cash discount of 2½% to his credit customers for payment within 15 days.

He buys inventory in bulk from a wholesaler for cash and receives trade discount of 4% for

orders in excess of $1500.

He pays staff wages each week in cash.

On 1 October 2011 Moloch’s cash book showed cash in hand of $650 and cash at bank of

$3200.

Moloch had the following transactions for the first week of October 2011. He writes up his

cash book and ledger each week.

| October | | $ |

| 3 | Cheque received from Justin for goods sold on 19 September | 390 |

| 4 | Sold goods on credit to Hercules | 800 |

| 5 | Paid cash to Andrews for goods purchased | 2880 |

| 6 | Cheque received from Munira for goods sold on 2 September | 150 |

| 7 | Cash sales for the week | 3650 |

| 7 | Wages paid for the week | 630 |

REQUIRED

(a) Make the necessary entries in Moloch’s cash book on the following page to record the

above transactions for the week ended 7 October 2011.

(b) From the information given above, and the entries in the cash book, write up the

accounts in Moloch’s ledger below to record the transactions for the week.

- Revenue (sales) account

- Purchases account

- Discount received account

- Discount allowed account

- Hercules account

- Justin account

- Munira account

(c) From the information given above, and the entries in the cash book, write up the

accounts in Moloch’s ledger below to record the transactions for the week.

Moloch had trade receivables of $8200 at 31 October 2011 and is concerned that some of

his credit customers may not pay their outstanding debts.

He proposes to create a provision for doubtful debts of 5% of his trade receivables.

REQUIRED

(d) Explain what is meant by a provision for doubtful debts.